Zinc Ingot Price Chart, Historical and Forecast Analysis | Procurement Resource

During the initial quarter of 2023 in the Asia Pacific area, the zinc ingot market displayed a blend of trends. A surge in demand from downstream industries, particularly in China, bolstered the market, despite disruptions from holidays and economic hurdles. Buyer purchasing power remained robust, supporting this trend. However, the succeeding quarter witnessed adverse effects stemming from heightened inventories due to increased mining activities. With subdued demand and inquiries alongside challenging economic conditions, the prices of zinc ingots declined from 24,340 RMB/ton in January to approximately 19,712 by June. In Europe, first-quarter demand saw an uptick, but limited trade, fluctuating buyer confidence, and amplified global mining activities contributed to a downward trajectory in the second quarter. North America observed stagnant prices due to consistent demand and inflation, aggravated by a decrease in construction activity and economic downturn.

Request for Real-Time Zinc Ingot Prices: https://www.procurementresource.com/resource-center/zinc-ingot-price-trends/pricerequest

Definition

A zinc ingot is a solid block of refined zinc metal, typically cast into rectangular shapes for convenience. Zinc is a bluish-white, lustrous metal that exhibits good electrical conductivity and malleability. It has a relatively low melting point and is corrosion-resistant, forming a protective layer of zinc oxide on its surface when exposed to air. Zinc ingots are used in various industries due to these properties, ranging from galvanization and alloy production to battery manufacturing and corrosion-resistant coatings in construction and automotive applications.

Key Details About the Zinc Ingot Price Trend:

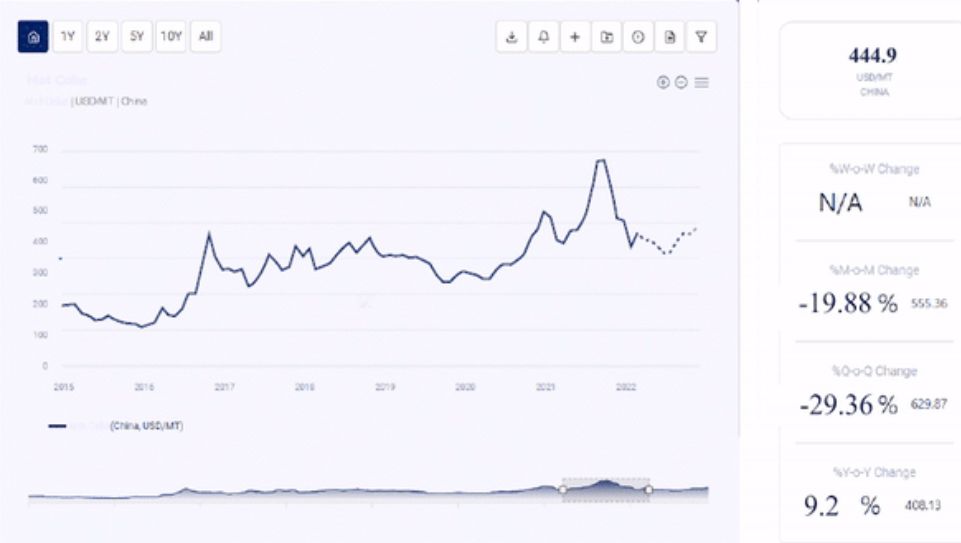

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on Zinc Ingot in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as Excel files that can be used offline.

The Zinc Ingot Price trends, including India Zinc Ingot price, USA Zinc Ingot price, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting the Zinc Ingot Price Trend:

Zinc ingots possess distinctive properties that make them highly valuable across various industrial sectors. One primary application involves galvanization, employing zinc-coated surfaces to shield structures, pipelines, and automotive parts from corrosion. Additionally, zinc plays a pivotal role in alloy production, acting as a crucial element in alloys like brass and die-cast zinc-aluminum variants, thereby elevating their mechanical attributes. In the realm of batteries, zinc ingots contribute significantly to zinc-carbon and zinc-air battery technologies. Moreover, they serve the construction industry by providing robust, corrosion-resistant coatings for steel and iron structures. These diverse applications underscore the crucial role of zinc ingots in preventing corrosion, enhancing alloys, advancing battery technology, and fortifying construction materials.

Zinc ingots possess distinctive properties that make them highly valuable across various industrial sectors. One primary application involves galvanization, employing zinc-coated surfaces to shield structures, pipelines, and automotive parts from corrosion. Additionally, zinc plays a pivotal role in alloy production, acting as a crucial element in alloys like brass and die-cast zinc-aluminum variants, thereby elevating their mechanical attributes. In the realm of batteries, zinc ingots contribute significantly to zinc-carbon and zinc-air battery technologies. Moreover, they serve the construction industry by providing robust, corrosion-resistant coatings for steel and iron structures. These diverse applications underscore the crucial role of zinc ingots in preventing corrosion, enhancing alloys, advancing battery technology, and fortifying construction materials.

Key Players:

- REAZN S.A.

- Henan Yuguang Zinc Industry Co Ltd

- Yifengxin (Hebei) Metal Production Co Ltd

- Siyaram Impex Pvt Ltd

- Phoenix Industries Ltd

News and recent developments:

Zinc fell -0.17% to 238.35 yesterday as a result of poor demand and increased supply. China, the world’s top user of zinc, reported significantly lower imports of the metal in April, showing that demand in the world’s second-largest economy remains weak. Meanwhile, output increased by 8.97% year on year to 540,000 mt in April. In addition, SMM forecasts that domestic refined zinc output in May will climb by 19,800 mt to 559,800 mt, indicating an 8.65% year-on-year increase, as routine maintenance is completed and power supply in Yunnan is eased.

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team tracks the prices and production costs of a wide variety of goods and commodities, hence providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients with up-to-date and pioneering practices in the industry to understand procurement methods, supply chains, and industry trends so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Christeen Johnson

Email: sales@procurementresource.com

Toll-Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA